Special Conditions for Traders from South Africa

$5

minimum investment

The minimum investment amount starts from $5 depending on the region. And you can open your first deal with just $1 to start opening deals at Pocket option.

0% fee

on deposits and withdrawals

Experience quick transaction processing and enjoy the benefit of 0% platform fees. Everything you require for smooth and hassle-free trading.

$10 000

bonus for demo account

You can learn making deals and check your strategies at a demo account receiving a nice virtual funds bonus.

What is Pocket Option?

By the end of 2018, they achieved a significant milestone, surpassing the one million user mark. Since then, this broker has registered over 10 million users and counting.

Pocket Option, originally aimed at the global market, now serves traders from over 100 countries, including South Africa. It has become one of the most popular brokers in South Africa, thanks to its attractive trading conditions.

Operating under the umbrella of Infinite Trade LLC, this entity complies with the regulatory oversight of the Mwali International Services Authority (License T2023322). Such meticulous regulation ensures a secure and reliable trading environment.

Recommended by the Community of Traders

Consistently leading among accessible and innovative brokers, according to specialized analytical resources focused on Forex and Options Trading.

The company’s focus extends beyond online trading; it emphasizes the development of an international community through social trading.

The brokers’s maximum transparency is reflected in its offering of a free demo to every registered user. These features allow traders to personally experience the platform’s superb interface, speed, and system stability. Join us today and start trading!

Reliable and Safe Platform for Trading

– Data Encryption: Advanced encryption protocols protect user data and communications.

– Secure Payment Processing: Safe payment gateways ensure secure financial -transactions.

– Two-factor authentication (2FA) is available for both login and fund withdrawals.

– Advanced security settings for the account.

– Risk management tools, including stop-loss orders, take-profit orders and other feature.

Everything You Need for Successful Trading

Wide range of trading instruments (currency, stocks, indices, commodities, cryptocurrencies, etc.);

Convenient access from all devices;

Social trading module – follow successful traders;

Apps, bots, and free signals;

No penalty for inactivity;

Automatic and guaranteed order execution;

Analytical tools for asset price forecasting;

Fast trading mode with trades as short as a few seconds;

Opportunities With Pocket Option

Different payment system

With over 50 payment methods at your disposal for deposits and withdrawals, you can experience fast transaction processing and enjoy 0% platform fees.

24/7 support

You can always reach our 24/7 multilingual support for assistance through various channels: support ticket, email, or phone call.

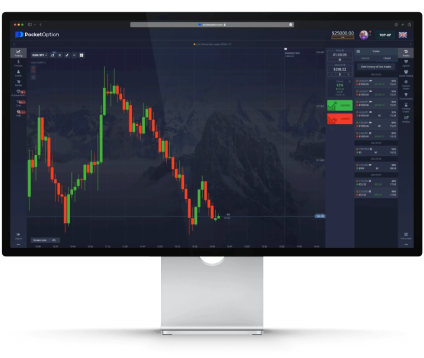

Unique trading platform

Broker has developed a unique trading platform to ensure stable trading for traders and investors. Trade yourself, repeat trades of other users, participate in tournaments.

What is PocketOption?

South Africa Pocket Option is a binary options broker that offers over 100 different assets, including currency pairings, stocks, and cryptocurrencies.

Is Pocket Option available in South Africa?

Pocket Option South Africa is not only available in the country it is South Africa’s Best Online Trading Platform.

How to use Pocket Option?

1. Choose from more than 100 assets: сurrencies, stocks, indices, cryptocurrencies,commodities.

2. Set a trade amount. The minimum trade amount is just $1.

3. Predict the price direction. Will the price go up or down?

4. Get your profit!

Does Pocket Options have commissions and fees?

Trading Pocket Option has no hidden trading fees. Deposits on a trading account are free of charge. For withdrawing funds, only Perfect Money will charge a fee (0.5 percent), and the bank that makes the transfer may charge a fee.

Where is company headquarters located?

Republic Of Costa Rica, San Jose- San Jose Mata Redonda, Neighborhood Las Vegas, Blue Building Diagonal To La Salle High School with the registration number 4062001303240.